Not known Factual Statements About Summitpath Llp

What Does Summitpath Llp Do?

Table of ContentsEverything about Summitpath LlpOur Summitpath Llp DiariesRumored Buzz on Summitpath Llp7 Simple Techniques For Summitpath Llp

Most just recently, introduced the CAS 2.0 Method Growth Training Program. https://hearthis.at/summitp4th/set/summitpath-llp/. The multi-step training program includes: Pre-coaching placement Interactive group sessions Roundtable conversations Individualized mentoring Action-oriented mini prepares Firms aiming to broaden into advisory services can additionally turn to Thomson Reuters Technique Ahead. This market-proven methodology uses content, devices, and assistance for companies thinking about advising servicesWhile the modifications have opened a number of development chances, they have actually likewise led to challenges and issues that today's firms require to carry their radars. While there's variation from firm-to-firm, there is a string of typical challenges and issues that have a tendency to run sector vast. These include, yet are not limited to: To remain affordable in today's ever-changing governing setting, companies must have the ability to quickly and effectively conduct tax research study and improve tax obligation reporting effectiveness.

Furthermore, the new disclosures might bring about a boost in non-GAAP measures, historically a matter that is highly inspected by the SEC." Accounting professionals have a whole lot on their plate from governing adjustments, to reimagined business models, to an increase in customer assumptions. Equaling it all can be difficult, yet it doesn't need to be.

What Does Summitpath Llp Do?

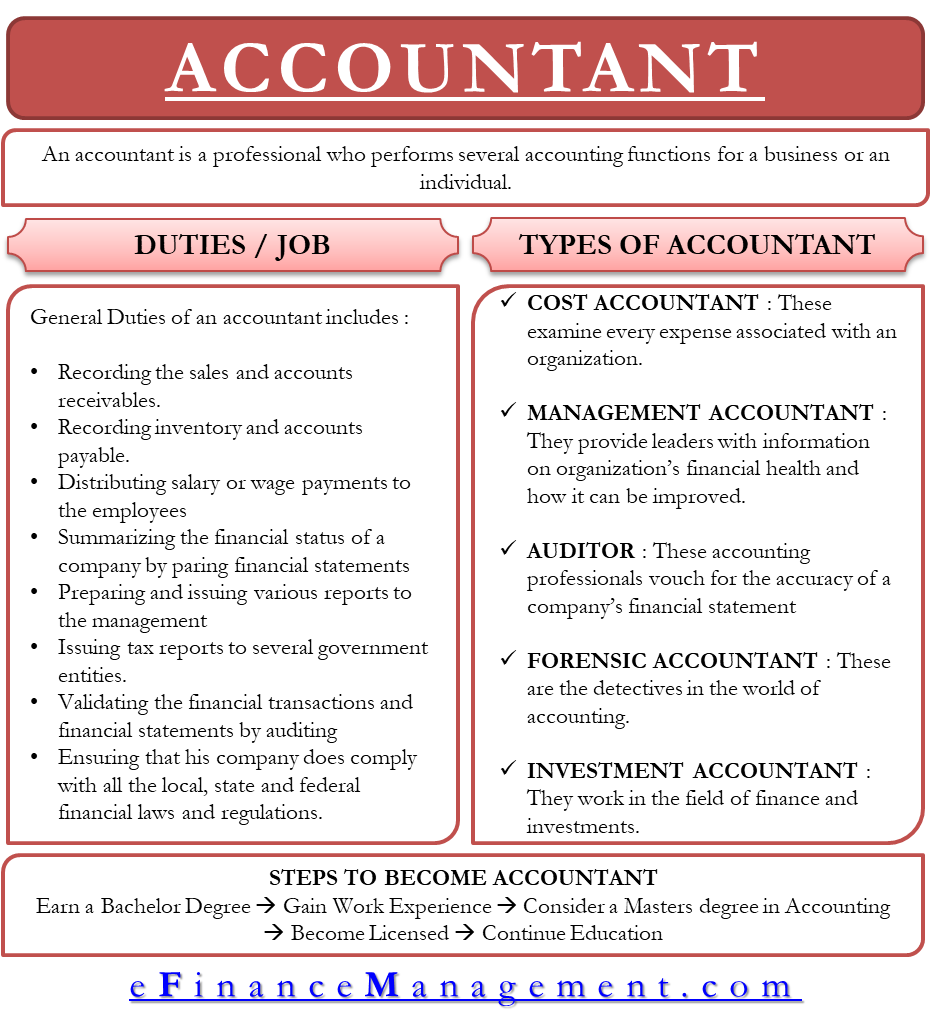

Listed below, we define four CPA specialties: taxes, monitoring audit, economic coverage, and forensic accountancy. CPAs focusing on taxation help their customers prepare and submit income tax return, reduce their tax concern, and prevent making errors that can result in expensive charges. All CPAs need some expertise of tax obligation legislation, but specializing in taxes suggests this will be the focus of your job.

Forensic accounting professionals typically begin as basic accountants and move right into forensic audit duties over time. Certified public accountants that specialize in forensic audit can often relocate up into management bookkeeping.

No states require a graduate level in audit. Nevertheless, an audit master's degree can help pupils meet the CPA education and learning requirement of 150 credit ratings because a lot of bachelor's programs just call for 120 credit scores. Audit coursework covers subjects like finance - https://www.quora.com/profile/SummitPath-LLP, auditing, and taxation. Since October 2024, Payscale records that the typical annual salary for a certified public accountant is $79,080. Calgary CPA firm.

Bookkeeping also makes functional sense to me; it's not simply academic. The Certified public accountant is an essential credential to me, and I still get proceeding education credit scores every year to maintain up with our state requirements.

Some Of Summitpath Llp

As a self-employed specialist, I still utilize all the standard structure blocks of audit that I learned in college, seeking my certified public accountant, and working in public accountancy. One of the important things I really like about accounting is that there are several tasks offered. I determined that I intended to begin my occupation in public accountancy in order to learn a lot in a brief duration of time and be revealed to have a peek at this site different types of customers and various locations of accounting.

"There are some workplaces that do not want to take into consideration someone for an accounting duty who is not a CPA." Jeanie Gorlovsky-Schepp, CPA A certified public accountant is a really beneficial credential, and I wanted to position myself well in the market for numerous jobs - Calgary Bookkeeping firm. I made a decision in university as an accounting significant that I wanted to attempt to obtain my certified public accountant as soon as I could

I have actually fulfilled plenty of terrific accounting professionals who do not have a CPA, however in my experience, having the credential truly aids to promote your proficiency and makes a distinction in your compensation and profession alternatives. There are some offices that don't desire to take into consideration someone for an audit function who is not a CERTIFIED PUBLIC ACCOUNTANT.

The Of Summitpath Llp

I really enjoyed functioning on numerous sorts of tasks with various clients. I found out a lot from each of my coworkers and clients. I worked with several not-for-profit organizations and found that I have an interest for mission-driven organizations. In 2021, I chose to take the following action in my accounting occupation trip, and I am now a self-employed audit specialist and company consultant.

It remains to be a development location for me. One essential high quality in being a successful certified public accountant is really caring concerning your customers and their companies. I like collaborating with not-for-profit clients for that really factor I really feel like I'm truly adding to their objective by helping them have good monetary info on which to make wise organization choices.